I Know What I Need To Do

…and I can do it on my own.

When it comes to your personal finances you probably already know that it’s wise to:

- Live on less than you make

- Pay yourself first

- Invest for retirement

- Get life insurance

- Pay down debt

- Have an emergency fund

It’s likely that you’ve even told yourself that it was time to get your finances in order. You know that you will. Someday.

The problem is, you haven’t. Yet.

Myth #1: I can do it on my own

A year after having my son I was at my pre-pregnancy weight. I should have been celebrating, right? I did. To a degree. I was happy with my weight, but my body wasn’t my pre-pregnancy body. I knew what to do. I’d been doing it. All of it. Eat healthy. Exercise. Drink plenty of water. Check. Check. And check. I was doing every single one of those things. So why did I still have spaghetti arms and a roll of fat that mushroomed over my pants every time I sat down?

Beyond knowing what I needed to do and tried to do on my own, I knew I needed someone who would push me, encourage me and hold me to a higher standard.

I remember the day. July 2007. Sitting in my office I made the call. I remember telling the trainer, “I’m embarrassed about my stomach.” His reply, “If you commit to working with me, you won’t be embarrassed for long.”

Boom!

We set goals, created a plan and logged my progress. Because I was paying a fairly decent amount for each session, I never missed my 5 am workouts which I went to three times a week. Once a week I had to share my food journal with my trainer. Sharing your numbers, weight and calories consumed, that’ll keep you focused!

He was right. Four months later I wasn’t embarrassed about my stomach. With my 21 month old in tow, I celebrated as I rock’d my bikini in Hawaii.

What’s that got to do with money?

Truth Be Told

Most people really do know what to do when it comes to their personal finances, just like I did when it came to losing baby weight.

I know what to do, I just don’t know HOW to do it.

Ok good. Now we’re getting somewhere. Knowing what to do isn’t the problem, it’s actually making sense of where to start that’s the challenge.

It’s true. Figuring out what to invest in, how to invest and how much to invest is complicated. Let alone trying to create a budget and get out of debt. If you try to do all three things at the same time and without guidance, it can be overwhelming.

Unclear about where to start? Let’s start with what NOT to start with.

What NOT to do as your first step:

- DON’T start by trying to create a budget.

- DON’T start investing.

- DON’T start paying extra on your debt.

But aren’t all of these things, creating a budget, investing, and paying down debt, all things that I should be doing and will help me improve my situation?

They are good things to do, yes. They just might not be the best first step.

As a simple first step, you want simple right?

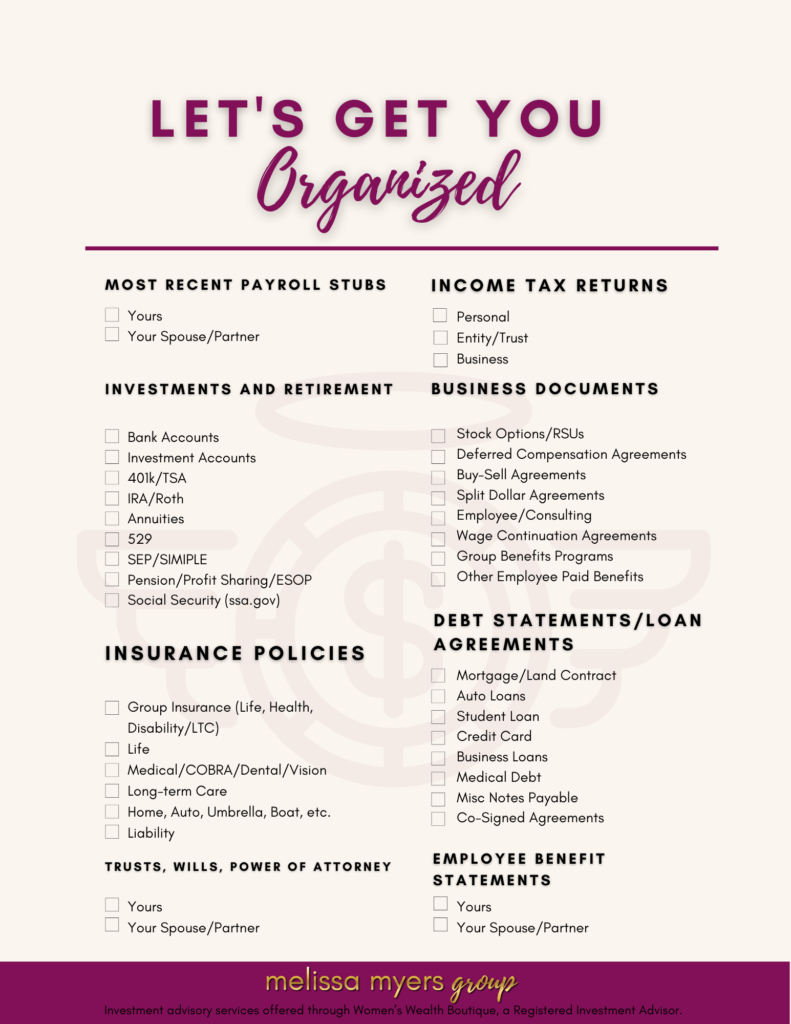

Downloadable: Let’s Get YOU Organized

Even if you have online accounts for everything, collect your statements and make a list of what you have, where you have it, how much is there and who has access either as an owner or beneficiary. Include contact info for your insurance agent, accountant and attorney along with the location of your tax documents and estate plan.

If you want better results with your finances, start by getting organized.

Once you’re organized you will have the information you need to gain a clear understanding about your finances.

I’ve been watching my credit score and it’s improving. Plus, I’m investing and getting a match from my employer so I should be good right?

My suggestion is that you change how you measure “good.” Instead of using your credit score as a measure of your financial health, I recommend using your net worth as the indicator.

What you own (your assets) – What you owe (your debt) = Your Net Worth

When your net worth is increasing you’re going in the right direction. At a minimum track your net worth once a year. While you’re getting your plan in order, building assets and paying off debt, look at your net worth weekly or monthly. Looking at your net worth more frequently will help you stay focused on your goals.

I know it’s probably a good idea to work with a financial planner, but I’m afraid of what you’ll tell me.

Not ready to learn the truth about where you stand? Is that because of the pain you think you’ll have to endure? Less fun, more saving? Living on a budget and saying “no” when it comes to spending? That it’ll be too complicated and time consuming or that it won’t be worth it? Afraid of the cost of advice?

If these truths resonate with you consider the true cost if you don’t get the help you need.

What and who do you value most in life?

My family, faith and friendships are most important to me.

Do you make a conscious effort to align your life and your money with your values?

I’m ready to help if you’re ready for a gentle nudge, to be encouraged and held to a higher standard with your wealth. Like working with a personal trainer, who’ll record your weight and measurements, we’ll measure your financial health, by calculating your net worth. Then we’ll create and work a plan that is based on your goals, and log your progress along the way. You’ll understand what you’ve been doing that has been beneficial and realize what is missing in your financial picture or that can be improved.

Ultimately, you’re in charge of your outcomes. You decide what recommendations to implement and in what order. My job is to educate you so you can make an informed decision.

Have you considered the real costs of procrastination?

If you’ve been DIY (doing it yourself) with your finances, getting a second set of eyes on your finances, even if it’s just to confirm that you’re on the right track and not missing anything is wise. You may be relieved to hear that you’ve got a rock-solid plan and that all your bases are covered. On the other hand, you could learn that something’s missing or could be improved. That there are risks you were unaware of or simply haven’t addressed. Wouldn’t you be relieved to learn what was missing and that you could take action to correct the omission before it was too late?

Speaking of risks. When it comes to portfolio risk you might learn that you don’t have to be so aggressive in order to accomplish your goals. On the flip side, you might discover that you need to adjust your allocation, adjust your goals, or both.

If you don’t take the time to make the call, send the email and commit to a higher standard, who will you be hurting by knowing what to do, yet not doing it?

Curious about learning more? Contact Melissa Myers, CFP® today for a Complimentary Welcome Call

Even if you know what to do regarding personal finance, you may be missing important elements that could by costly in the long run.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All investing involves risk including loss of principal. No strategy assures success or protects against loss.